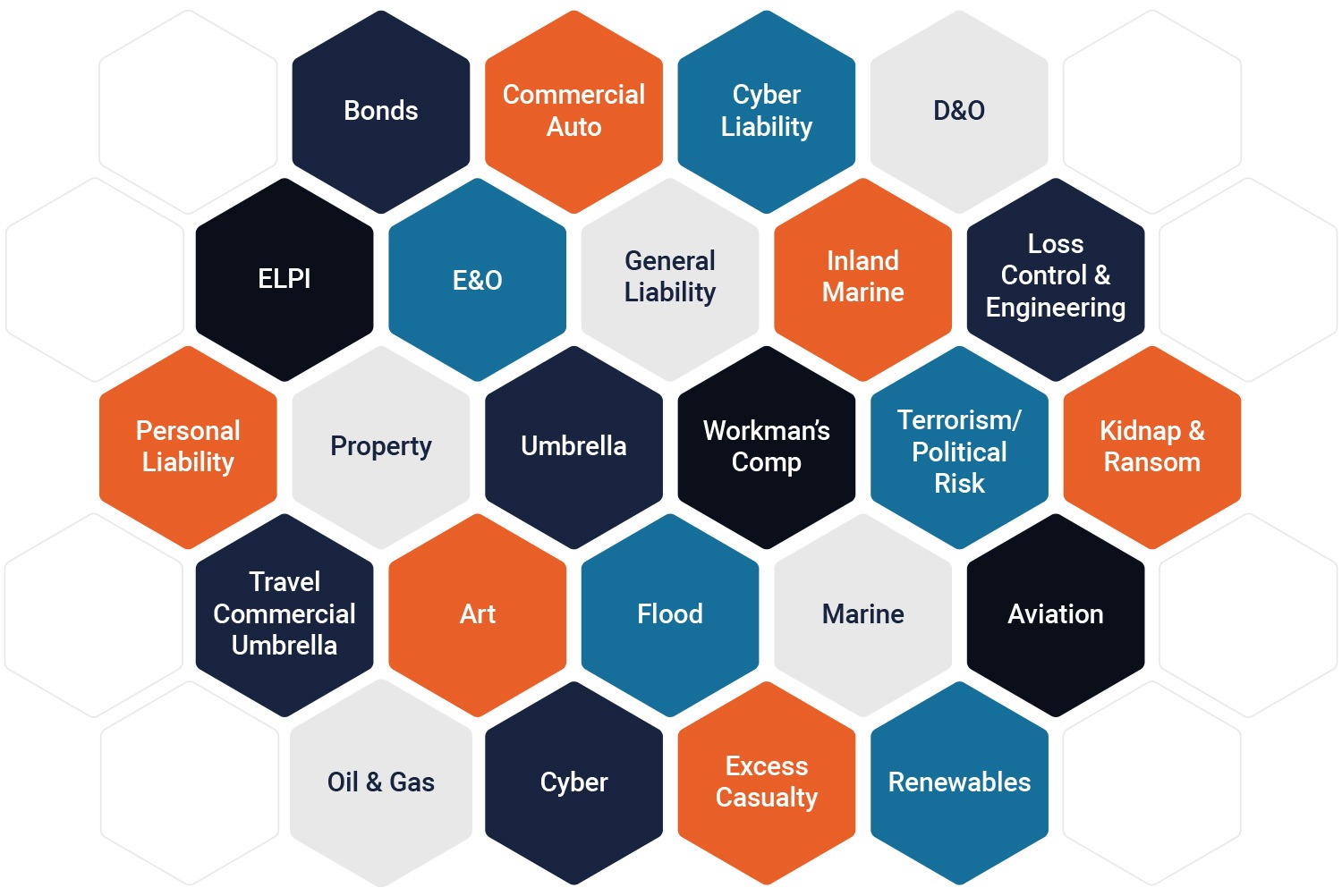

Our product capabilities are continually evolving to meet our clients needs

INTX, understands that every insurer is unique, with its own requirements and challenges. There is no off-the-shelf insurance solution, that caters to an insurer’s controls and ambitions. To answer to our client’s requirements we dedicate an in-house development team that is equipped with the insurance and software development expertise to create a tailored solution that address even the most intricate and complex challenges our clients face

From software development to implementation, maintenance, and integration, our team of code engineers handles every aspect with precision, dedication and care, ensuring that your needs are met with the highest attention to detail and efficiency.

INTX Insurance Software is a web based system

The application and the data can be supported on cloud or, on-prem solutions.

INTX Insurance Software assumes the same risk as the carrier on implementation and functionality of our insurance solutions

INTX’s fees are based on the system being fully functional and operational before any fees are charged.

INTX Insurance Software © Copyright 2024